Copia Removes Collaboration Barriers

for Wealth Owners and their Managers

The average number of managers that ultra-high net worth individuals and family offices have is seven. Many have upwards of twenty.

It is a common source of pain understanding which managers outperform, which are innovating vs. stagnating. On top of this, it's hard to identify what should be priority topics of inquiry with each manager.

Patron Profile

Amanda is a 54-year-old VC with a passion for tech startups. She's married with three adult children, each of which is budding entrepreneurs themselves. She holds diverse asset classes, including real estate, private equity, private stock, from her early career. Amanda has a strong finance background and intuitively understands what makes good investment sense.

Amanda has a range of managers handling various aspects of her portfolio. She gets statements regularly, but she can never tell who's doing well or not. She hates logging in to all of the advisor portals. Her executive assistant tries to consolidate her documents once a quarter.

- She has 13 alternative asset managers, all with different specialties that she wants to regularly benchmark and analyze.

- Her most significant asset class is venture capital; she has over seven funds that vary in stage, geographic, and industry focus.

- The "raw numbers" aren't an issue, but the trendlines are hard to substantiate.

- She is worried some managers are feeding on her balance sheet but are clever about obfuscating it.

- She feels like she "never logs in" to her current system and wants to regain tighter control (without going through her managers to understand her wealth.)

The Copia Journey

Amanda's journey is not unusual. Within the first two weeks of onboarding, Copia:

“Before Copia managing my capital calls was a nightmare. I spend hours and hours trying to do reliable cash forecasting, but it rarely is. Copia makes it way easier to understand what my current cash situation is and what is coming up in as real-time as possible, which makes me happy.”

Amanda S.

Tech Venture Capitalist

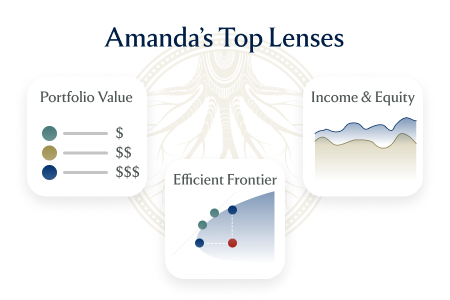

Success Metrics

Success is defined differently by every Patron. For Amanda, success looks like:

Discover What Success Looks Like For You

Copia helps investors and wealth owners be more effective stewards of capital. Get in touch and we'll show you how to increase confidence and reduce errors.

Fine Print

Our Patrons come from a wide variety of backgrounds, experiences, and family configurations. Many experience similar challenges managing their wealth. We submit that our case studies are reflective of a typical user and their situation. Due to our patrons' highly confidential nature, we've chosen to fictionalize details about accounts, names, marriage status, and net worth.